The death of physical retail has been predicted for quite some time. This sentiment has grown during the Covid-19 pandemic as e-commerce numbers increase. It is true that the pandemic has accelerated trends that were well underway prior to the pandemic; “normal” is no more. Physical retail is not dead. As we swiftly move into a new age of retail (what I call The Customer Channel), I argue that physical retail must be central to your Direct-to-Consumer strategy.

Boring retail, or legacy laggards as Bain & Co. says, was dying and is now just dying faster. Stores remain important – definitely important, but they now can play a different role in the overall direct to consumer strategy. Retailers must be empathetic and supportive of their customers in every way. Let’s focus on the ongoing relevance of physical stores so we all can understand better the changing nature of retail.

Let me state this now – The US Census Bureau News has reported that as of Q3 2020, e-commerce accounted for 14.3% of the total US retail sales. Clearly, we are still shopping in physical stores.

Does this mean physical retail remains relevant? Yes. We are shoppers. We are social. We are tactile. We are impatient. And maybe, we still need to get out of the house…

So, what’s changing? The organizational lines and silos that traditionally separated channels have blurred. Omnichannel is here. And, I venture to say we have moved beyond omnichannel, or even a unified shopping experience. We are now in the era of The Customer Channel. Retailers now seamlessly support and empower their customers to shop where and how and when they want.

AN EXPANDING ROLE

There is an online/offline connection like never before. This is a key element of the “blurring” I reference above. There’s also a lot of “unsexy” shopping that has traditionally brought us into stores. This is one area the pandemic has really impacted. Let’s take grocery. We need to eat – more than ever as we are home more than ever. Though we may be ordering online, we are often driving to the store to pick up our purchases (or, maybe it’s better to say for someone else to place our purchases in our trunk).

Kohl’s has publicly spoken about their initiatives to increase volume via “a focus on active and casual wear, increased personalization of its loyalty and rewards programs, and enhanced omnichannel capabilities.” How about this point regarding leveraging their stores for fulfillment: “Today, nearly 40 percent of the company’s digital sales are now fulfilled by its stores – this is through ship-from-store and buy online, pick up in store.”

EXPERIENTIAL RETAIL & MORE

Many brands believe physical retail adds tremendous value to their performance. Though there have been over 4,000 stores close in 2020, some retailers are still opening stores – from luxury to discount grocers. Let’s look at some examples.

Loro Piana opened a new 1,700 sqft store in Manhattan’s Meatpacking District. This is more than a store – it’s experiential. In addition to an even split of women’s and men’s collections, the store includes artist collaborations, an indoor garden, live events, knitwear personalization, made to order footwear programs and more.

“It’s a special atmosphere. We’re excited to arrive in the neighborhood. It’s so dynamic with a good mix of art and design and brands making a statement,” said Fabio D’Angelantonio, chief executive officer of Loro Piana in Yahoo!Life.

Slowear has recently opened new stores in Chicago and Brooklyn. This is one of my favorite apparel brands. Not only are their stores beautiful, comfortable, inviting and reflect their Italian heritage and sensibility perfectly, their apparel collections are first rate and their Slowear Journal represents the brand’s lifestyle.

CEO Roberto Compagno stated in Vogue Business, “The store expansion is part of the company’s broader direct-to-consumer strategy and designed to build a relationship with customers. Experience is essential. We want to test a different customer. The physical store is to give support and give service. It’s the easy way to show who you are to the consumer.”

Allbirds sells beautifully designed and manufactured shoes that are extremely comfortable – and sustainable. I can attest to the compelling storytelling, ease of purchase and to the comfort of their shoes. I wear them.

For a digitally native brand to venture into physical retail, there has to be a reason. “In terms of why we chose to come to Philly, we already had a significant e-commerce customer base in the Philadelphia area and felt that there would be healthy demand for an in-person shopping experience,” said Travis Boyce, Allbirds’ head of global retail operations recently in the Philadelphia Inquirer.

Nike continues to focus their attention on their direct to consumer strategy. Learnings from their ongoing retail experimentation seem to have directly influenced the announcement that they are opening 150-200 Nike Live stores. Their customer base, shopping habits and purchase history have influenced the store location strategy as well as store-level assortment. Talk about The Customer Channel… well, here it is at work.

Along with the continued evolution of their business that includes a significant increase in assortment offering, integration of Nordstrom and Nordstrom Rack businesses and channels and the result of success of Nordstrom Local stores, Nordstrom is the quintessential example of what I mean by The Customer Channel.

“At the heart of our business transformation is the recognition that the unique combination of the Nordstrom and Nordstrom Rack brands, along with our combined physical and digital expertise, create a powerful opportunity to get closer to the customer than ever before,” said CEO Erik Nordstrom in their recent earnings call as reported in Retail Dive.

I continue to watch, shop and applaud RH. They have proven the value that physical stores provide to a brand. Now, they are taking this idea to an entirely new level; an entire ecosystem of physical experiences in Aspen, including an RH Gallery, RH Guesthouse, RH Bath House & Spa, RH Restaurants and the company’s first RH Residences as reported in Designers Today.

A few additional brands that continue to open stores are Aldi, PGA Superstore, Tractor Supply Company, and others.

TECHNOLOGY

Let me just touch on this here, as a deeper dive in the explosion of retail technology will follow.

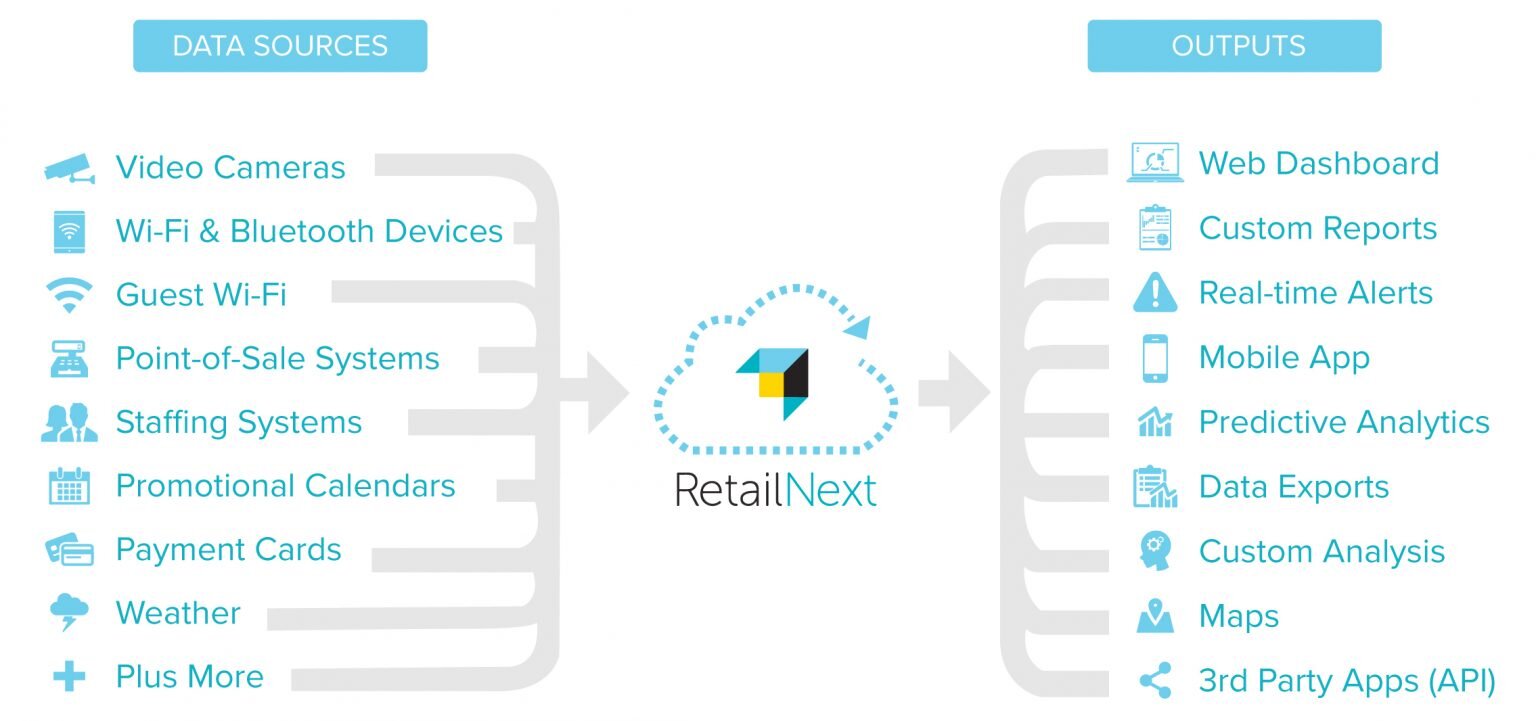

Technology has fueled an increased ease of researching, browsing, selecting, purchasing, returning and/or exchanging on mobile devices, tablets and desktops – let alone in store. Let’s not forget about AI-powered search and recommendations, inventory visibility, true personalization, predictive analytics, experiential e-commerce, virtual shopping, improved 3D product visualization and much more. I’d be remiss to not mention social commerce, with Snapchat a recent entry.

I look forward to diving into retail tech in future posts. This is an incredibly dynamic time in retail.

CONCLUSION

Stores aren’t going away. Well, some are. For one thing, we are overbuilt in the US. For another, it’s just too easy to shop for some things online. And, the disruption the pandemic has caused will continue to impact financial performance and viability of some retailers. Consumer shopping habits have changed.

Let’s remember physical stores still make up the vast majority of where we purchase. Today, having a clear consumer-centric direct-to-consumer strategy with physical retail playing a central role is required. We’re in era of the Customer Channel.

Please follow me on LinkedIn, check out my website and visit me on Instagram.